2023 Online Gambling Expansion Forecast

In 2023, Playin USA predicts the legalization of sports betting in two new states while we forecast one new successful online casino legislative effort. Additionally, four new states will launch sports betting next year, resulting in a 20% growth in overall handle.

Here’s a look at where things stand today, for 2023 and beyond.

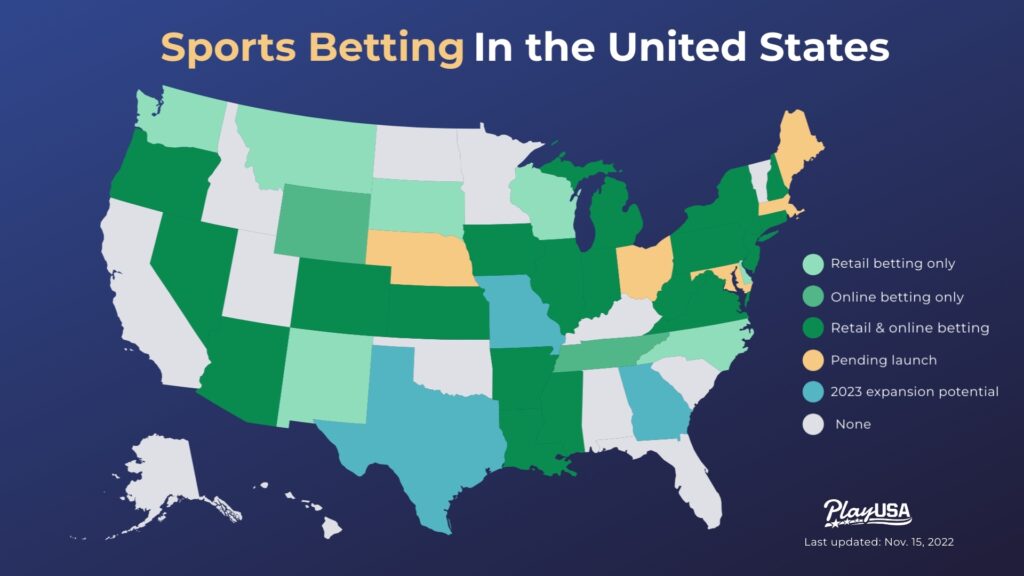

The US sports betting market today

Sports betting has become legal in the US at a breakneck pace since the federal ban fell in 2018. As we sit here today, however, hundreds of millions of people still don’t have access to legal online sports betting in their states. The three largest states in the union – California, Texas and Florida – are still off the map.

Legal online gambling on a wider scale – most notably, online casinos – is still in its infancy in the US, with fertile potential ground for expansion. As with sports betting, some of the biggest prospects rest with some of the biggest states, including New York.

Key takeaways for 2023

- S

ome mature betting markets are beginning to approach their ceiling - Four pending launches will have an impact on the financials

- Playin USA forecasts Texas as the best chance for legalizing online sports betting

- Playin USA forecasts at least two more states legalizing sports betting

- Online casino remains an untapped market

- Playin USA forecasts Indiana as the best chance for legalizing online casino

As we sit here today, sports betting is legally available in 31 states and the District of Columbia. Four more states have laws in place and are awaiting launch, while Maryland is working on expanding its existing retail-only industry into the digital realm.

Once the pending markets are all up and running, legal sports betting will be available to almost 60% of American adults, spanning 35 states and Washington, D.C.

Among the currently regulated jurisdictions, nine remain retail only by law while the other 23 allow statewide betting online. Six of those retail operations are tribal exclusive. These active markets together generated north of $45 billion in handle during the first half of 2022, up more than 90% from the first half of 2021. Operators have won more than $4 billion from bettors so far this year.

Our forecast ends the calendar year with just under $100 billion in combined handle across the map, though a strong second half conceivably could breach that big milestone.

The US sports betting market of tomorrow

Today’s numbers aren’t tomorrow’s numbers, of course, and the US sports betting market is firmly still in the clutches of the biggest expansion of legal gambling in the nation’s history.

The performance of the active markets mostly has exceeded expectations, particularly in some of the most recent additions such as Arizona and New York online. Driven by promotional spending in the early scramble to acquire customers, these younger states appear to be reaching a running pace more quickly than their predecessors.

So what’s left for growth?

Growth potential from existing betting markets

Recent revenue trends seem to indicate some of the country’s most mature markets are beginning to approach their ceiling.

New Jersey, for instance, is suddenly watching Illinois close the gap in its rear-view mirror as its own pace slows. While New Jersey is still on track to end the year with double-digit growth, the past few months of data reveal the first signs of an actual pullback. New York’s expansion is no doubt responsible for some of the falloff, but it’s also apparent that maturity itself is approaching. Our lookahead line has New Jersey slipping backward by just a few percent in 2023, but some modest continued growth wouldn’t be a surprise, either.

Illinois is about a year behind on its path to maturity, currently growing at a rate comparable with New Jersey’s parabolic 2021. If things continue along this trajectory, the two markets should be pretty much equal in size by the end of 2023 – both generating between $11 billion-$12 billion in handle for the year. Illinois should inch ahead of New Jersey soon by virtue of the population disparity alone.

Michigan and Pennsylvania, meanwhile, seem to be approaching their own, lower ceiling. Growth has tapered off in those markets – particularly in the latter – with activity leveling off below most national comps. Annual handle per capita is hovering around $500 in both, whereas states such as Colorado, Indiana and Iowa are trending well over $800 this year. Colorado is tracking closer to $1,000.

Pennsylvania also figures to be negatively affected by expansion in New York and the pending launch in Ohio, creating some uncertainty around its future performance. It’s hard to see what could spark another growth spurt in the coming year, making the commonwealth more likely to take a step backward than a step forward in 2023.

Along those lines, it’s tough to square the early success of new online markets such as Arizona and New York with the relative sluggishness of these maturing markets elsewhere. Maybe there’s still another big surge to come for the latter group as the sports calendar fills back up. Or perhaps the bloating effect of early promotional spending in these younger markets foreshadows a coming period of pullback for them.

The busy fall season will tell us a lot about the remaining potential for growth among these two subsets of the market as they exist today. Our 2023 model predicts just more than $100 billion in total handle for existing markets, representing a same-state growth rate in the single digits.

Growth potential from new markets

The four pending sports betting launches, however, will make a significant impact on the financials for 2023.

Ohio is a top 10 state by population, and the regulatory structure there is poised to create one of the largest markets in the country. Massachusetts is similarly well positioned to capitalize on its own population and its dominance of the New England sports landscape to become a force in the industry.

The expected addition of these markets brings our total handle outlook for 2023 closer to $120 billion.

Maryland sports betting (Q4 2022)

Voters approved a referendum way back in 2020. And while retail sportsbooks are already live in the state, Maryland online sportsbooks went live on Nov. 28.

After fits and starts, regulators in the state finally got their act together and seem poised to allow the first sportsbook apps and sites to launch in November and December.

The dates each operator will launch and in what order are still moving targets, but Maryland will at least launch during the NFL regular season and in time for the next Super Bowl. A spring or summer launch would be far less ideal.

We project just under $500 million in operator revenue and $4 billion in wagers in the first full year of Maryland sports betting in 2023.

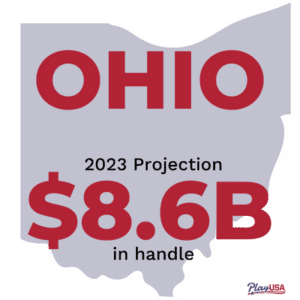

Ohio sports betting (January 1, 2023)

The pending rollout of sports betting in Ohio is among the top topics of conversation this fall, and rightly so. Ohio’s big population and its affinity for sports and gambling bode particularly well for its prospects as a sports betting market.

PlayOhio forecasts between $9 billion and $12 billion of handle in Ohio at maturity, and recent trends seem to suggest an especially quick ramp-up.

Ohio’s best-in-class framework will create the largest synchronized launch in US history, with several retail sportsbooks and, perhaps, two dozen online apps available on Day 1.

Our 2023 target is an optimistic $8.10 billion in handle and about $600 million in operator revenue, which could be enough to secure Ohio a spot in the US top five in its very first year of operation.

Massachusetts sports betting (Q1 2023)

After years of work, lawmakers finally came to an agreement on legalized sports betting in Massachusetts. The enacted framework isn’t amazing, but it should be plenty good enough to make Massachusetts’ sports betting industry thrive. Presuming a full launch in January, operators should expect to win close to $400 million in revenue on some $5 billion in wagers in 2023.

A Massachusetts sports betting launch also figures to have a measurable negative impact on New Hampshire, Connecticut, and Rhode Island, all of which are currently benefiting from their neighbor’s lethargy by welcoming customers across the border. Though frustrating for now, this existing familiarity should help Massachusetts bettors jump into their own regulated industry at a running pace.

Nebraska sports betting (Q1 2023)

Nebraska legalized sports betting via voter referendum in 2020, but regulators still are putting the pieces in place for launch. There is no firm timeline, but we think Q1 2023 is still a realistic possibility.

While it will be convenient for some local bettors, the retail-only implementation will make Nebraska one of the smallest sports betting markets in the country for the foreseeable future. Its launch also may have a small negative impact on Colorado, which currently has one of the most robust local sports betting industries.

Maine sports betting (Q1 2024)

Speaking of no firm timeline, Maine officials are in no hurry to activate their legalized sports betting industry. The enabling legislation was enacted at the end of this year’s legislative session, and regulators clearly stated their intention to crawl through the process slowly.

Our best guess for launch is Q1 2024, though it wouldn’t be a surprise to see Maine turn green before the end of 2023. Online betting will allow Maine to maximize its revenue potential, but the ceiling is still low, given its small population and the lack of major sports within its borders.

Forecasting sports betting expansion

As big as the sports betting party has become in the US, there’s still plenty of room for more guests. And some of the VIPs are notably late for the festivities. New York is the only one of the Big Four states with legal sports betting today, creating a few huge holes in the map.

California sports betting

As the most populous and most visited state in the country, California represents the true prize of US sports betting. And legalization, which seemed within reach, now seems like it faces a complicated and perhaps lengthy path.

Voters in California faced a pair of propositions related to sports betting at the ballot box in November – Prop 26 allowing tribal retail sportsbooks and Prop 27 that would legalize online sports betting more widely.

Both measures failed badly, with more than $400 million spent on advertising for and against the props.

A regulated California sports betting industry could conceivably surpass $50 billion in annual handle and $3.5 billion in revenue at maturity, numbers that would dwarf every other market in the country.

Tribes in California are the gatekeepers of how, when and if sports betting will become legal in California, and they proved their ability and desire to block a legalization scheme this election cycle. The animosity generated between the tribes and the US-facing sportsbooks will be hard to reconcile, meaning compromise between the two factions on what a

California sports betting industry should look like will be difficult to reach.

Playin USA forecast: Earliest legalization could likely take place via the ballot again in 2024, but a 5-7 year horizon for legalization is probably more plausible.

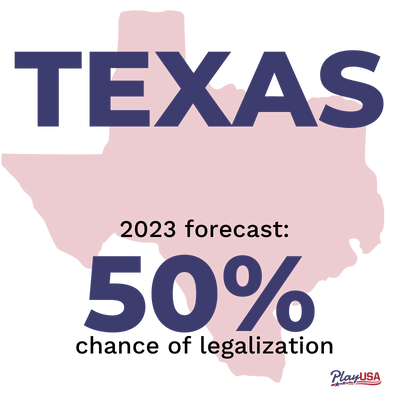

Texas sports betting

If California is the crown jewel of US sports betting, Texas would be its shiny leather boots. Number two in population, Texas is rich in sports and betting interests despite the absence of legal casinos within its borders. A historical resistance to gambling casts a bit of a cloud over the prospects for legalized sports betting in Texas, but recent chatter seems to indicate broadening interest among local lawmakers.

A mature and modern Texas sports betting industry easily would be the second-largest in the country, perhaps not as big as California but quickly moving onto the podium beside it. Our preliminary forecast for Texas is $26 billion in handle and almost $2 billion in revenue for its first full year of operation.

Playin USA forecast: 50% chance of legalization in 2023.

Florida sports betting

Depending on who you ask, Florida already may have legalized sports betting.

A 2021 agreement between Gov. Ron DeSantis and the Seminole Tribe gave the latter exclusive control over the implementation, but a federal judge invalidated the underlying compact to leave its status in limbo. Hard Rock even took bets on its app for a few days before the operation was enjoined by the court, and the matter is now the subject of what could be a lengthy litigation.

As it stands today, there is no legal sports betting in Florida. From a financial standpoint, that’s quite a shame. A mature Florida sports betting market could generate north of $20 billion in annual wagers and $1.5 billion in revenue to rival New York for what would today be the top spot on the leaderboard.

Neither of the two states with more potential customers than Florida currently has legal sports betting.

Playin USA forecast: 0% chance of further legalization; short-term prospects depend on the federal court system

Other notable betting markets

There are only 15 states without legalized sports betting today, and a few of them conceivably could work their way off that list in 2023.

We’ve already talked about the top few, but Georgia is one of the biggest ones still outstanding. Its population rivals Ohio’s, and officials in Georgia have shown some recent interest in legalization, too. The strength and positioning of the state lottery could complicate the proposed implementation, but we’ll choose to be optimistic for now.

A mature Georgia sports betting operation would compete on the same tier as states such as Michigan and Virginia, capable of at least $8 billion in annual handle and $600 million of revenue.

Outside of the states we’ve already mentioned, Missouri is the only other one with a top-20 population but without legalized sports betting. It’s certainly not for a lack of trying. Missouri was among the first states to begin work on legislation in the wake of the US Supreme Court decision in 2018, but dozens upon dozens of bills have failed to find significant support in the years since. Prospects aren’t much better than a coin flip for the upcoming session, but launch in neighboring Kansas no doubt will help reignite the conversation.

A regulated Missouri online sports betting market could conceivably generate more than $5 billion in annual handle and perhaps $400 million in operator revenue under the proper framework.

Playin USA forecast: At least two more states legalize sports betting in 2023. A 90% chance a new state legalizes sports betting in 2023.

Online casino

While sports betting has gotten all the headlines in recent years, the largely untapped US online casino market still looms for the gambling industry.

Technology allows for a robust gambling offering online; casino games mostly have remained the remit of physical casinos. Online casinos are legal in New Jersey, Pennsylvania, Michigan, West Virginia, Connecticut and Delaware, with only online poker legal in Nevada.

That, obviously, leaves much of the US map open for legalization. Here’s what to watch for in 2023 and beyond.

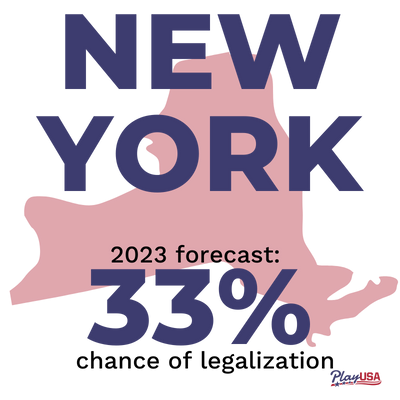

New York online casino

The biggest prize on the short-term map is New York. An effort came up out of the blue in 2022 and fell short, but there are hopes that a similar bill spearheaded by Sen. Joe Addabbo will bear fruit in 2023.

While sports betting legalization happened in 2021 despite then-Gov. Andrew Cuomo being at odds with the Legislature, there seems to be less concern of the governor’s office injecting itself into the discussion this time around.

New York lawmakers have witnessed revenue pour into New Jersey coffers from online casino.

A regulated New York online casino market could produce upwards of $3 billion in annual revenue, immediately becoming the most-profitable in the country.

Playin USA forecast: 33% chance

of legalization.

Indiana online casino

Indiana is unquestionably the best chance for legalization in 2023. There is a serious lobbying effort, along with key legislators already behind the effort. Indiana already has legal online sports betting, so the addition of online casino should, in theory, be a natural fit.

Indiana’s population is almost exactly one-third of New York’s, and its financial prospects are proportionally lower.

Legalized online casino games in Indiana could generate close to $1 billion in revenue annually.

Playin USA forecast: 60% chance of legalization.

Other states

The map starts looking less optimistic for other states to legalize in 2023, but Playin USA believes there will at least be legislation introduced in up to five other states: Illinois, Maryland, Colorado, Iowa and Missouri. Other states with online sports betting are always candidates to add online casino, as well. The largest states – California, Texas and Florida – are almost certain not to legalize in 2023 and will be unlikely candidates even in the long term.

Playin USA forecast: 10% chance any other state legalizes online casino.

About this story

Leading online gambling analyst Dustin Gouker contributed to this report. Kim Yuhl managed the project and created the images. Maria Healey and Derek Helling edited the story. Jason Schaumburg planned the article’s promotion.

Eric Ramsey and Dustin Gouker are available for interviews and additional context. Please contact Jason Schaumburg at [email protected] to make arrangements.

Projections and forecasts are based on historical data, industry sources, current market trends and expert analysis.

Fair Use Statement: Please link to the original article when sharing our stories or images.